Home Builders Association of Southeastern Michigan

The Industry Voice for Home Builders & Remodelers

Charitable Foundation

Advocacy

Events & Sponsorship

HBA of Southeastern Michigan

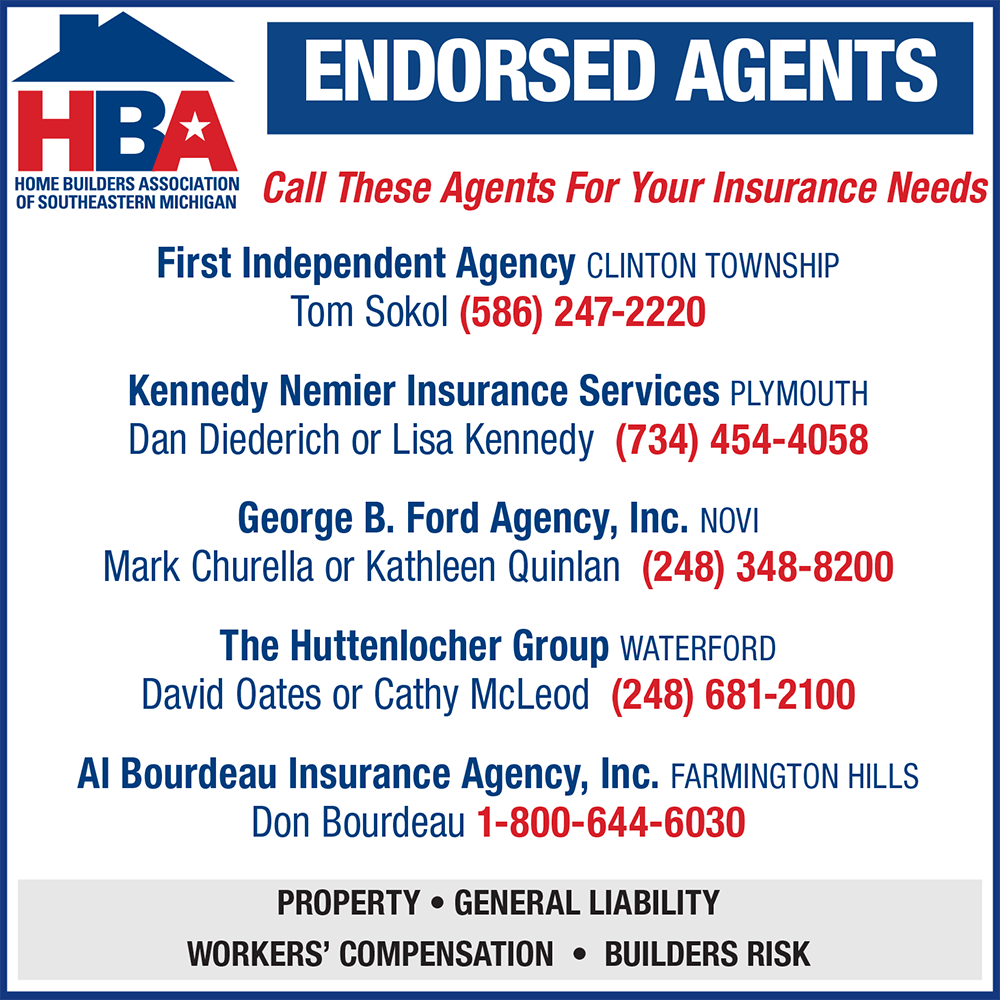

The HBA of Southeastern Michigan is a non-profit advocate for the home building industry, representing builders, remodelers, and suppliers. Our nationwide membership exceeds 235,000 individuals and companies, affiliated with the Home Builders Association of Michigan and the National Association of Home Builders.

Our mission: Serving Our Members by Promoting and Advancing the Building Industry.

News & Announcements

Read this week’s Building Industry News Briefing.

Members: Update Your Contact Information!

Scam Alert!

HBA Rebates is the only rebate program that is affiliated with HBA of Michigan. We are NOT affiliated with Builder Sourcing.